Blog

Blog

Out of Town Movers Reshuffling to Larger, More Affordable Homes

Scorching hot housing market giving additional buying power to sellers... read more

Ep 25: Double Your Title Orders with 1031 Exchanges

In this episode, Michelle Fitzpatrick explains the basics of the 1031 exchange program and what you can do to help save it. read more

Will More Money Make you Happier?

There is a lot of debate about whether money makes people happy. Some are big believers that money will bring you more happiness, while others feel there is a limit to what money can do. There was a major study done that showed making more money will make you happier... read more

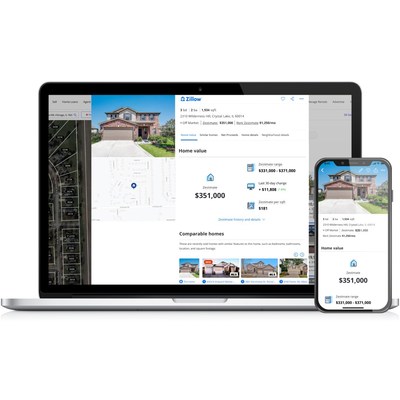

Zillow Launches New Neural Zestimate, Yielding Major Accuracy Gains

New model helps Zestimate better react to hot housing market and improves median error rate to 6.9% nationally... read more

Mortgage Rates Trickle Lower Yet Again

Mortgage rates fell again today--now officially below the lowest levels in the past 2 weeks. In order to accomplish that, rates had to fully erase the damage done exactly 2 weeks ago after the Fed announcement caused the biggest single-day spike in months. read more

Real Estate Investing (REI)

The Real Estate Investing certification program is for REALTORS® who want to master the ins and outs of working with investors and those who are establishing themselves as real estate investors. read more

Mortgage Rates Inch Toward 2-Week Lows

Mortgage rates are primarily a function of trading levels in the bond market and bonds have enjoyed (or suffered) an interesting mix of volatility and stability in June. US Treasury yields (which share a strong correlation with ,mortgage rates) moved sharply lower...... read more

8 Tools Every Agent Should Know About To Dominate Social Media

In high school, your math teacher may have said something along the lines of, "You won't have a calculator with you all the time." Fast forward to today. With the power of smartphones, you have one at your disposal along with a lot of other things that make your life... read more

Residential Real Estate Disclosures with Bruce Aydt

Bruce and Monica discuss what should or should not be disclosed when it comes to current property status, past repairs, psychologically stigmatized properties, and work done without permit. read more

Pandemic Continuing to Fuel Home Price Gains

When the S&P CoreLogic Case-Shiller and Federal Housing Finance Agency's price reports for March were released we wrote that the superlatives were getting tired. The April report has prompted Case Shiller to roll out the term "extraordinary." Where do we go from ... read more